5 Questions to Ask Your Lenders During COVID-19

As many of us start to feel the financial impacts of the Coronavirus pandemic, we’re looking towards our mortgage lenders, credit card and student loan providers to help. Here are five questions you should ask when deciding to pause or postpone your payments due to financial hardship.

Separate from the fear we may have for our health, or the health of loved ones during the Coronavirus pandemic, many people are worried about the impact on something else… their bank accounts. This past week the United States doubled its previous record for unemployment applications, and even those that are able to keep their jobs or work from home may be nervous about what the virus means for their job security next week or next month.

So what does this mean for all the former and current moneymakers?

It needs most of us should be focused on increasing our emergency savings in the event we do lose our job, have an emergency, or to prevent us from going into debt down the road. Now, usually the recommendation (and a big goal for most people) is 4-6 months living expenses, but do you support a family member? Have children? Then you’ll want to get this number even higher, which is no easy task.

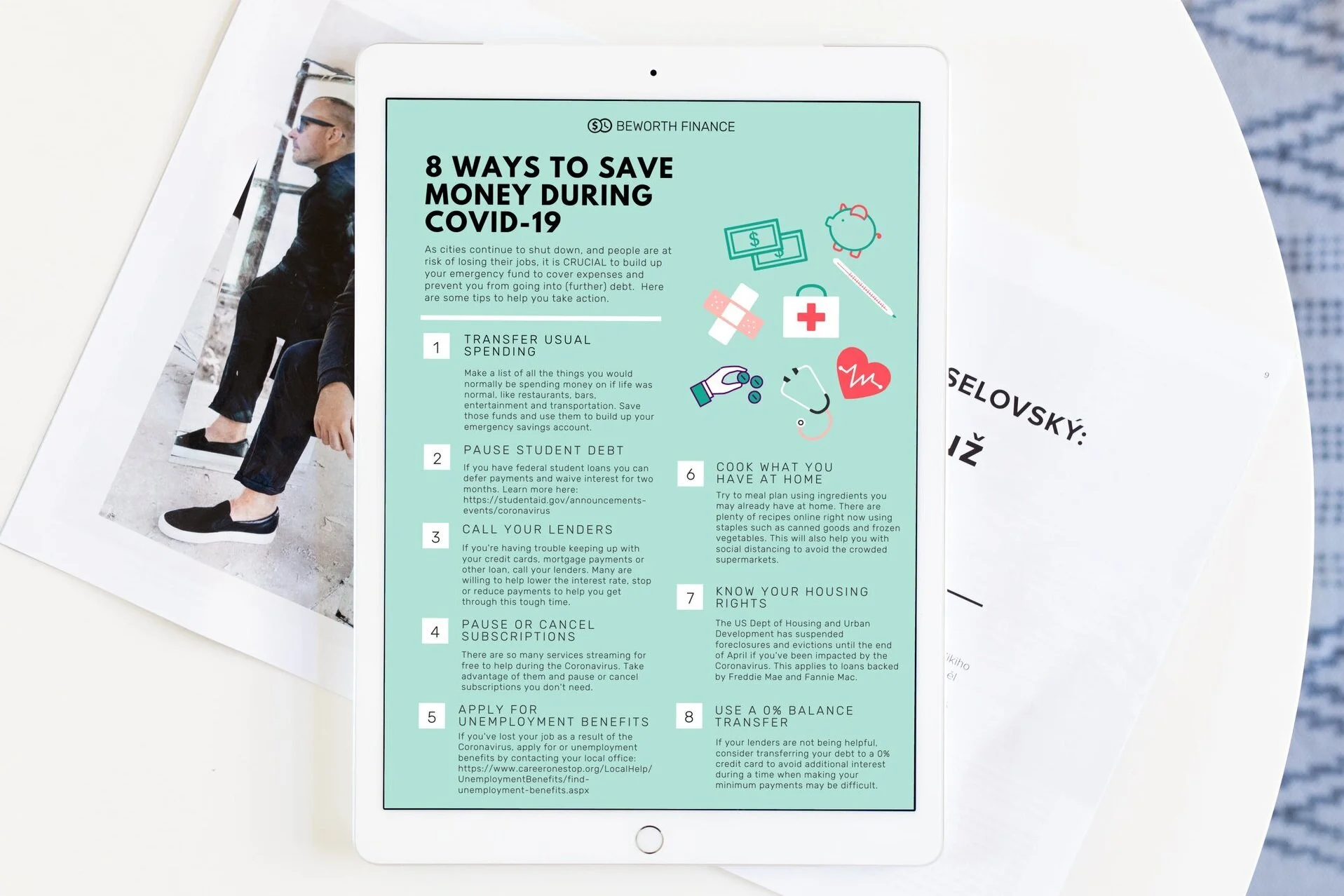

Here are a few ways you can increase your emergency fund today:

Getting a stimulus check? (Find out how much here) Put that straight to your emergency fund.

Transfer everything you were spending on everyday life, like restaurants, bars, transportation, and activities for your kids, etc. to your savings account until you have enough funds stashed away.

Pause your mortgage, credit card or student loan payments IF the terms make sense (more on this below)

Temporarily reduce contributions to your retirement fund (401k, 403b, IR, etc.) and transfer those funds to your emergency savings

Luckily for many that have lost their jobs, banks, mortgage and student loan lenders are willing to work with the public during this time, but there are still a few questions you’ll want to ask. And if you’re fortunate enough to have the option of whether you continue your payments or not, does that mean you should take them all up on their offer?

No, not necessarily…

While pausing payments sounds great, there are a few factors you’ll want to take into consideration to make sure you don’t hurt your financial picture in the long run. And if you are experiencing financial hardship and don’t have much of a choice, at least you’ll be well informed and prepared for what happens when you’re required to repay. In the meantime, keep in mind the period for filing for unemployment has been reduced, so you can apply ASAP.

Whether you’re looking for financial relief or simply trying to increase your emergency fund, here are a few questions you’ll want to ask first when calling your lenders:

1. How long is the pause?

Keep in mind that even if a lender is willing to pause your payments, called forbearance, that this doesn’t mean the money you owe disappears. You will be responsible to make payments again at a later date, so you’ll want to know when that date is.

Secondly, don’t assume the pause is happening automatically. While some federal student loan payments have been paused (more on this below), mortgage and credit card lenders likely require you to apply to a financial hardship program to take advantage of this benefit. To be prepared, you’ll want to have documentation related to your current income, change in income, or future income if you’re expecting a loss. You’ll also want to be able to talk about or document your monthly budget (Don’t have one? Start here), and any changes to your financial situation, for example, if you have a letter from your current or former employer.

2. Is interest waived during this time?

Keep in the mind that just because your lender is willing to pause or reduce your mortgage or credit card payment, that this does NOT mean interest automatically disappears. In other words, your payments could be paused, but interest can still be accruing, meaning it will take you longer to pay off that debt over time. This makes this question REALLY important.

If the answer is yes, how long is it waived for?

If the answer is no, it’s not ideal, but at least you won’t be surprised when repayment starts back up and more of your payment is going towards interest than it had prior to the Coronavirus pandemic.

Thanks to the CARES Act, we know that interest has been waived on many federal student loans for the next six months (till September 30, 2020). This is a win-win because if you are having difficulty paying your loans, there is no reason for you NOT to postpone. If you’re not having difficulty, because interest is waived during this time, this means 100% of your payment (if you continue making payments) will go towards your principal balance a.k.a. you can pay down that student loan WAY quicker. If you’re in a position to do this, it’s a great way to get ahead of your debt. If you’re struggling, or need to increase your emergency fund, take advantage of the pause.

If you have private student loans, or a federal student loan that does not qualify for the CARES Act (for example, if your Federal Family Education Loan (FFEL) is owned by a private lender), you may still be able to work with your financial provider. It is definitely worth a shot giving them a call, and asking them these same questions to see what they can do to help. We’re all human and many are offering some type of program or leniency to help during this time.

Looking for more ways to save during the COVID-19 pandemic?

Check out this free PDF guide and other tools offered by Beworth by clicking below.

3. How will this impact my credit?

PRO TIP: Over half of American mortgages are backed by Fannie Mae or Freddie Mac (to find out if you’re one of this, check both these links: Fannie Mae and Freddie Mac). According to the CARES Act, this means they cannot foreclose on your home if you cannot make payments, you will not incur late fees, and you won’t have delinquencies reported to the credit agency.

Still have questions about mortgage relief? Check this out.

If your mortgage is NOT backed by Fannie Mae or Freddie Mac, you’ll still want to ask all of these questions. Ditto if you’re pausing payments on a credit card or student loan. Make sure that along with pausing the payment, this will not be reported to credit agencies as a delinquencies which would hurt your credit score and make it more difficult or more expensive (read: higher interest rate) to apply for credit down the road.

4. Will late fees be charged later?

When pausing payments, make sure late fees won’t be tacked onto payments you make at a later date. Just by visiting the home webpages of my own financial providers, it seems they are being pretty clear about this upfront (but are NOT clear about waiving the interest re #2 above, and many times are not waiving it, so be careful).

5. How will I be asked to make up this payment later?

Just because lenders are willing to pause payments now, doesn’t mean you get a free pass. You’ll likely be prepared to cough up the money at a later date, and whether that will be as a lump sum payment, gradual payments, and the timing of those payments can have a big impact on your finances. Make sure to ask when and how the money will be due at a later date. Many mortgage programs, for example, claim that they’ll be willing to revisit their respective hardship program and work with clients at the end of their initial [insert month]-forbearance period, but don’t assume this will be the case.

For those with federal student loans seeking public student loan forgiveness, any payments paused during this time do count towards your 120 payments, so no worries there.

I hope these questions will be helpful for those of you trying to catch a break during this time. If you still have questions, please know that I want to help. Feel free to shoot me an email at info@beworthfinance.com and I’m happy to do some digging for you.

We’re all in this together. Stay healthy moneymakers.